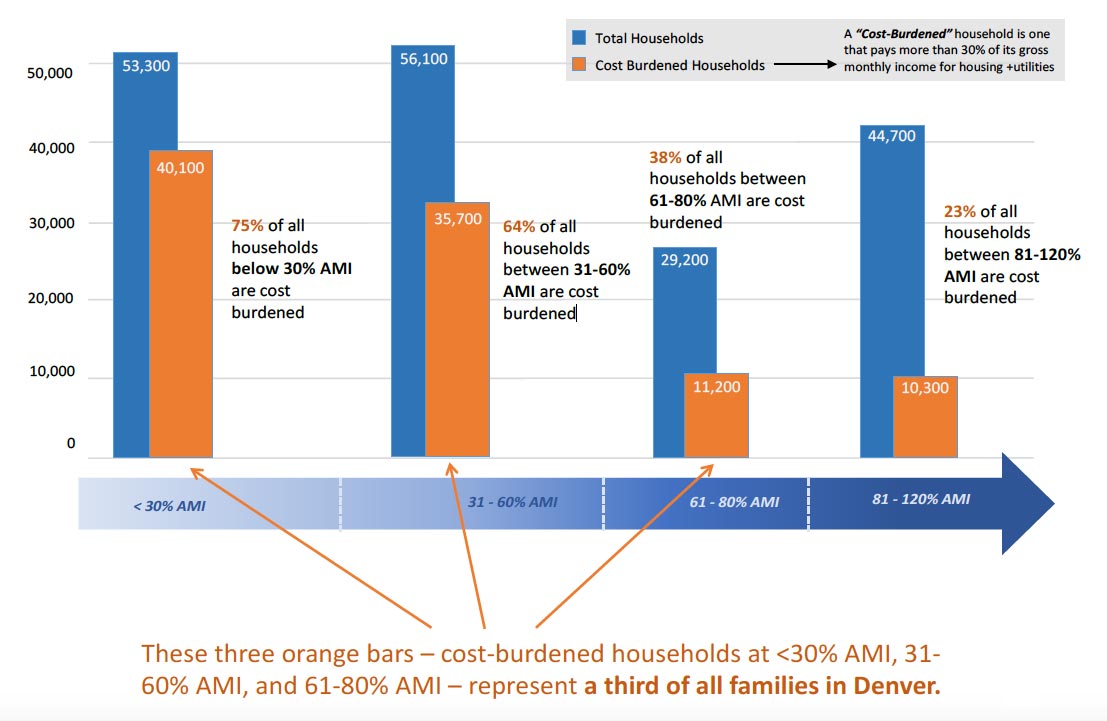

“Affordable” housing means paying no more than 30% of gross income for rent/mortgage plus utilities.

As the population of Denver has grown, access to affordable housing has become scarce, putting some of the most vulnerable members of our community at risk. While rents and property values are soaring, wages have not kept up with those increases.

One out of four renters in the Denver area now uses more than half of their income just to keep a roof over their heads - that’s 104,000 out of nearly 400,000 renter households.

For those attempting to purchase their first homes, challenges in the housing market are also evident. With housing prices rising so quickly, hitting an average sales price of $370,500 in Denver in January 2016, and the supply inadequate to keep up with demand, the goal of homeownership is simply not achievable for many households.

Without a stable place to live, families find it difficult to secure and retain employment, keep kids in school and stay healthy.

The housing crisis threatens our economy, too. Over the next five years, we’ll see more than 300,000 new residents flock to the region as the economy continues to improve and new businesses and jobs move here. But our economic growth could be hampered if innovative businesses and people choose to settle elsewhere because of a lack of affordable homes.